Notary near me: now in less than 10 minutes.

Navigating the world of vehicle titles can be tricky, especially if you find yourself needing a bonded title in Georgia. A bonded title, often referred to as a “surety bond title,” is a special type of title issued when the original title is lost or missing, and the ownership is in question. This process ensures that the rightful owner can claim the vehicle while protecting the state from potential fraud.

Understanding how to obtain a bonded title in Georgia is essential for anyone dealing with lost titles or purchasing a vehicle without a clear title. By following the correct procedures, vehicle owners can legally register their cars and drive with peace of mind. This guide will walk you through the steps and requirements, making the process as smooth as possible.

What Is A Bonded Title GA?

A bonded title GA, also known as surety bond title, serves as a legal document proving ownership of a vehicle when the original title is unavailable. In Georgia, these bonded titles help resolve ownership issues by providing a secure way to register and claim ownership of vehicles without clear title records. The state recognizes a bonded title as valid, which ensures protection against fraud for both the owner and the state.

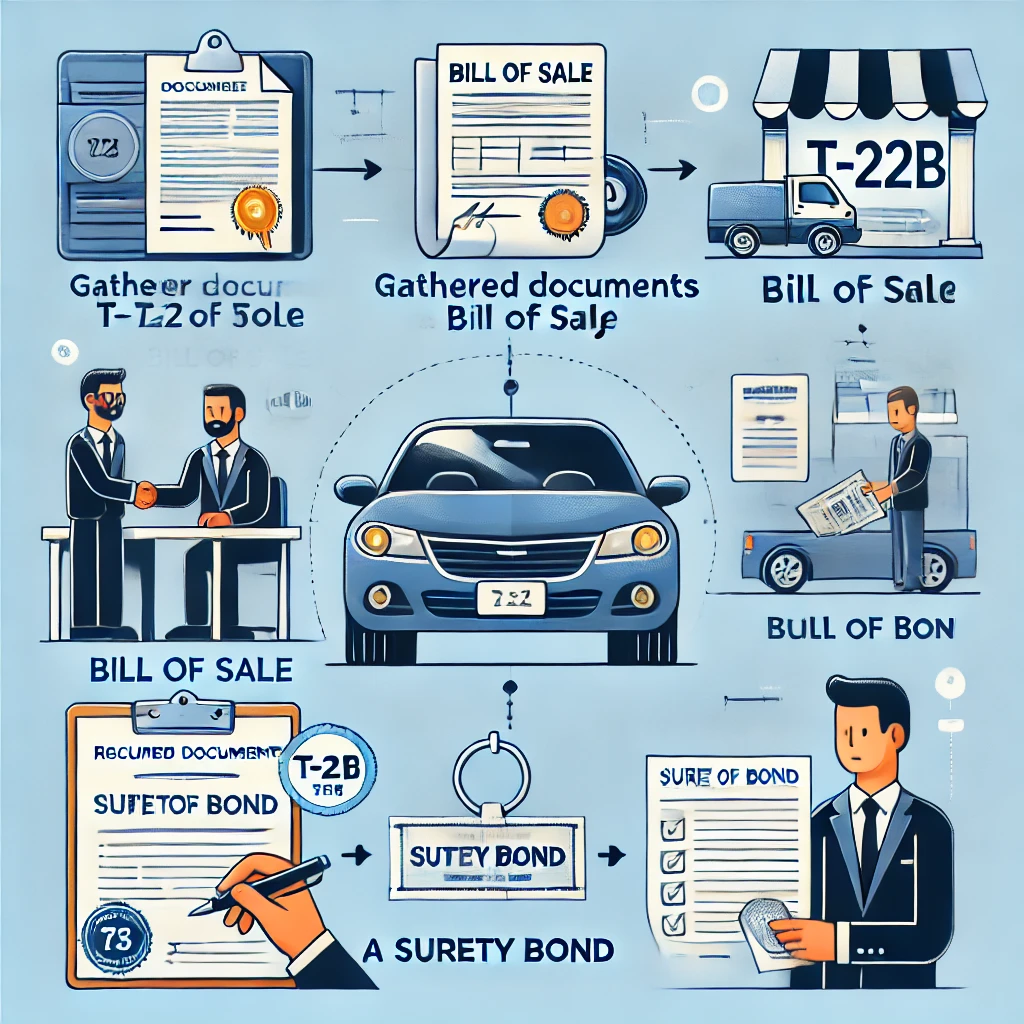

Individuals begin the process by obtaining a surety bond, typically valued at one and a half times the vehicle’s worth, from a bonding company licensed by the Georgia Department of Revenue (GDOR). The GDOR provides a list of approved bonding companies to streamline this step. After securing the bond, individuals submit it along with supporting documents, like a completed T-22B form (Certificate of Inspection), a completed T-4 form (Bill of Sale), and any available ownership evidence, to the GDOR.

A bonded title GA remains valid for three years. During this period, anyone with a legitimate claim to the vehicle can challenge ownership through legal means. If disputes arise, the surety bond covers the claim amount up to its bond value, ensuring fair resolution. After the three-year period without any claims, the bonded title can convert to a standard title, fully clearing any initial ownership disputes and verifying the current owner’s rightful claim.

Why You Might Need A Bonded Title In GA

Residents of Georgia may seek a bonded title for several reasons, especially when encountering issues related to vehicle ownership documentation.

Lost Or Stolen Titles

When original titles are lost or stolen, vehicle owners can’t verify ownership through standard means. Securing a bonded title offers a legal remedy. For instance, if someone misplaces their car title, they can obtain a surety bond and submit necessary paperwork to establish ownership and receive a bonded title. This process ensures that rightful ownership is documented and recognized by the state.

Incomplete Paperwork

Incomplete paperwork during vehicle transactions can hinder the transfer of ownership. If individuals purchase vehicles without clear titles or complete documentation, obtaining a bonded title can resolve such issues. For example, a buyer might lack a proper bill of sale or previous title signatures. By acquiring a surety bond and following state guidelines, they can validate ownership and legally register the vehicle.

How To Obtain A Bonded Title GA

In Georgia, obtaining a bonded title resolves ownership disputes when an original title is lost or unclear. Following specific steps ensures a smooth process.

Required Documentation

Compile essential documents first:

- Surety bond: Obtain from a GDOR-licensed bonding company at 1.5 times the vehicle’s value

- T-22B form: Certificate of Inspection by law enforcement or designated official

- T-4 form: Bill of Sale proving purchase details

- Vehicle identification number (VIN) verification: Confirm vehicle specifics

- Affidavit of Fact (Form T-228): Provide a sworn statement about the vehicle’s history and title issues

Application Process

Submit documentation accurately:

- Secure a surety bond from a licensed bonding company.

- Complete the T-22B form through a law enforcement or authorized individual.

- Fill out the T-4 form with the seller’s and buyer’s signature.

- Verify the VIN.

- Collect all forms and affidavits.

- Submit forms, affidavit, and supporting documents to the GDOR Motor Vehicle Division.

Ensure each form is filled correctly to avoid delays.

Timeline And Fees

Understand timelines and fees to anticipate processing:

- Processing time: Generally 4-6 weeks for review and approval

- Fees: Vary, including bond cost (1.5 times vehicle value) and filing fees (standard state rates)

Expect possible delays during high-volume periods. Once approved, maintain the bonded title for three years without claims to transition to a standard title.

Advantages And Disadvantages Of A Bonded Title

A bonded title offers specific benefits and drawbacks, making it essential for Georgia residents to understand both aspects before proceeding.

Pros

- Legal Proof of Ownership: A bonded title provides legal proof of ownership for those with lost or disputed titles. This allows vehicle owners to register and operate their vehicles legally.

- Fraud Prevention: It guards against fraud by ensuring that ownership claims are evaluated and validated through a surety bond. The bond serves as a financial guarantee, verifying the owner’s claim against potential disputes.

- Simplifies Transactions: It simplifies vehicle transactions where the original title is missing. Buyers and sellers can complete deals confidently, knowing the bonded title offers security and legitimacy.

- Path to Standard Title: After three years, a bonded title can transition to a standard title if no ownership claims arise. This conversion resolves initial disputes and affirms the current owner’s rightful claim.

- Challenges Claims: During the three-year validity, anyone with a legitimate claim can challenge the bonded title. This presents a risk of ownership disputes.

- Time and Cost: Obtaining a bonded title involves time and costs, including bond procurement and filing fees. Processing can take 4-6 weeks, posing a delay in vehicle registration.

- Temporary Solution: The bonded title is a temporary solution until it converts to a standard title. This interim period may inconvenience owners seeking immediate resolution.

- Market Perception: Vehicles with bonded titles may face scrutiny or lower market value due to the provisional nature of the title. Buyers might hesitate, impacting sales.

Tips For A Smooth Bonded Title Process In GA

Gather All Required Documents

Collecting necessary documents simplifies the bonded title process in Georgia. Essential items include the surety bond, a T-22B form (Certificate of Inspection), a T-4 form (Bill of Sale), and a VIN verification. Verify that each document is accurate and complete before submission to avoid potential delays.

Choose A Reputable Bonding Company

Selecting a licensed bonding company approved by the Georgia Department of Revenue (GDOR) is crucial. Confirm the company’s credentials and read client reviews to ensure reliability. Using a reputable company helps prevent issues during the bond procurement process.

Ensure Accurate Completion of Forms

Completing each form accurately ensures a smoother process. Fill out the T-22B, T-4, and Affidavit of Fact (Form T-228) with precise details. Double-check information for consistency across all documents. Errors can result in processing delays or rejections.

Submit Documents Promptly

Timely submission of all forms and documents to the GDOR aids in a quicker bonded title approval. Delays in submission can extend the timeline, causing potential complications. Aim to submit everything promptly to meet the processing time of 4-6 weeks.

Track Application Status

Monitoring the status of your application keeps you informed of any issues or additional requirements. Check with the GDOR for updates and respond to requests promptly. Staying informed minimizes unexpected delays.

Consider Professional Assistance

Consulting with a professional can offer guidance and reduce errors. Bonding companies or title service experts can assist in navigating the process and ensuring compliance with all requirements. This professional help can save time and effort.

Understand The Bonded Title Validity Period

A bonded title in Georgia remains valid for three years. During this period, any legitimate ownership claim can challenge it. Be prepared to manage any such disputes, knowing the surety bond covers valid claims up to its bond value. After three years without claims, transition to a standard title is possible.

Maintain Good Records

Keeping organized records of all documents and communications concerning the bonded title ensures you can quickly address any issues. Clear documentation helps resolve disputes and supports your claim to the vehicle. Retain copies of all submitted forms, the bond, and correspondence.

Discover the Power of BlueNotary:

Integrate your Business, Title Company, or Law Firm to Satisfy your Customers and Decrease Turnaround

Get a document Notarized/Sign-up

Join the Free Notary Training Facebook Group

Conclusion

Navigating the bonded title process in Georgia can be challenging but it’s essential for resolving ownership disputes and protecting against fraud. By securing a surety bond and submitting the necessary documents to the GDOR individuals can legally establish vehicle ownership. Understanding the steps and requirements ensures a smoother registration process and paves the way for converting to a standard title after three years. While the process has its complexities, the benefits of obtaining a bonded title far outweigh the challenges, offering peace of mind and legal clarity for vehicle owners in Georgia.

Frequently Asked Questions

What is a bonded title in Georgia?

A bonded title, or “surety bond title,” is a legal document proving ownership of a vehicle when the original title is unavailable. It resolves ownership disputes and protects against fraud for both the owner and the state.

Why might I need a bonded title in Georgia?

You might need a bonded title if the original title is lost, stolen, or if you purchase a vehicle without clear title documentation. It serves as a legal remedy for verifying vehicle ownership.

How do I start the process of obtaining a bonded title in Georgia?

Begin by obtaining a surety bond, valued at 1.5 times the vehicle’s worth, from a bonding company licensed by the Georgia Department of Revenue (GDOR).

What documents do I need to apply for a bonded title in Georgia?

You need a surety bond, T-22B form (Certificate of Inspection), T-4 form (Bill of Sale), VIN verification, and Affidavit of Fact (Form T-228).

How long does it take to get a bonded title in Georgia?

The processing time for a bonded title in Georgia is typically 4-6 weeks once all required documents are submitted accurately to the GDOR Motor Vehicle Division.

How long is a bonded title valid in Georgia?

A bonded title is valid for three years. After this period, if there are no ownership claims, it can be converted to a standard title.

What are the costs associated with obtaining a bonded title in Georgia?

Costs include the surety bond premium, which varies, and standard filing fees to the GDOR.

What happens if someone challenges my ownership of the vehicle during the bonded title period?

If ownership is challenged, the surety bond covers claims up to its value. After resolving the claim, the bond protects the rightful owner and the state.

Can a bonded title affect my vehicle’s resale value?

Yes, the temporary nature and potential ownership claims can affect market perception, possibly impacting resale value.

How can I ensure a smooth bonded title process in Georgia?

Gather all required documents, choose a reputable bonding company, complete forms accurately, submit documents promptly to GDOR, track application status, and maintain good records. Consider professional assistance if needed.

Leave a Reply